California Paystub Requirements 2024. New updates to pay data reporting. Posted on january 1, 2024.

February 1, 2024 | joshua henderson and christopher patrick © jackson lewis. In january 2024, california again updated its pay data reporting website for the 2024 reporting cycle.

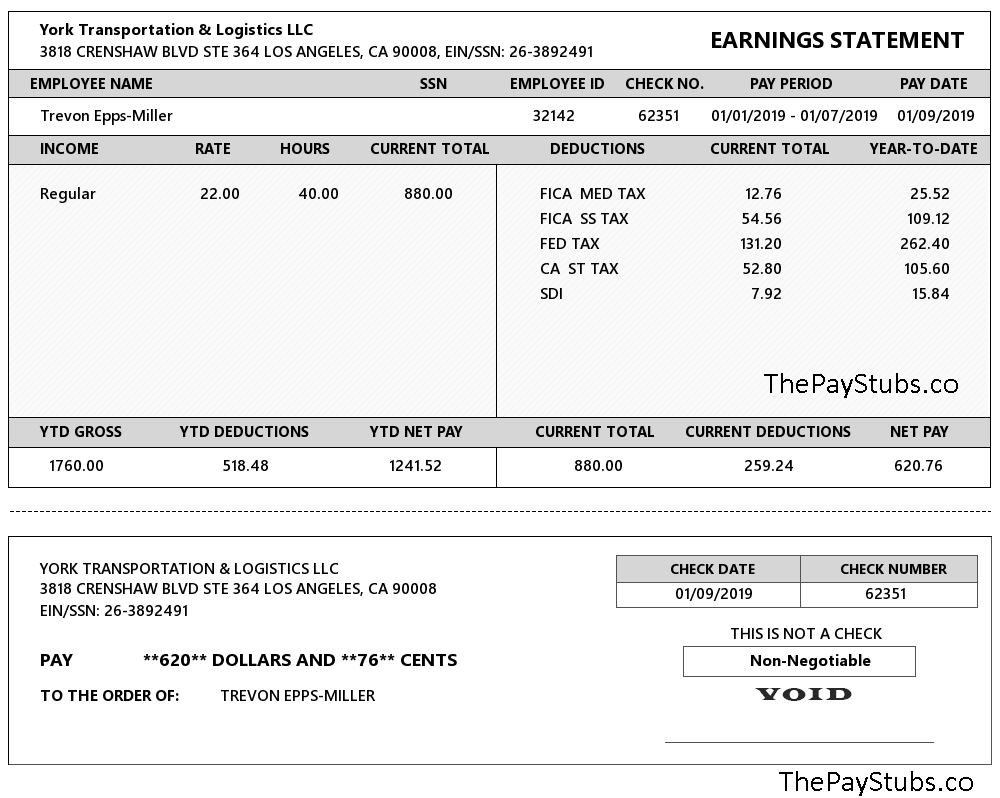

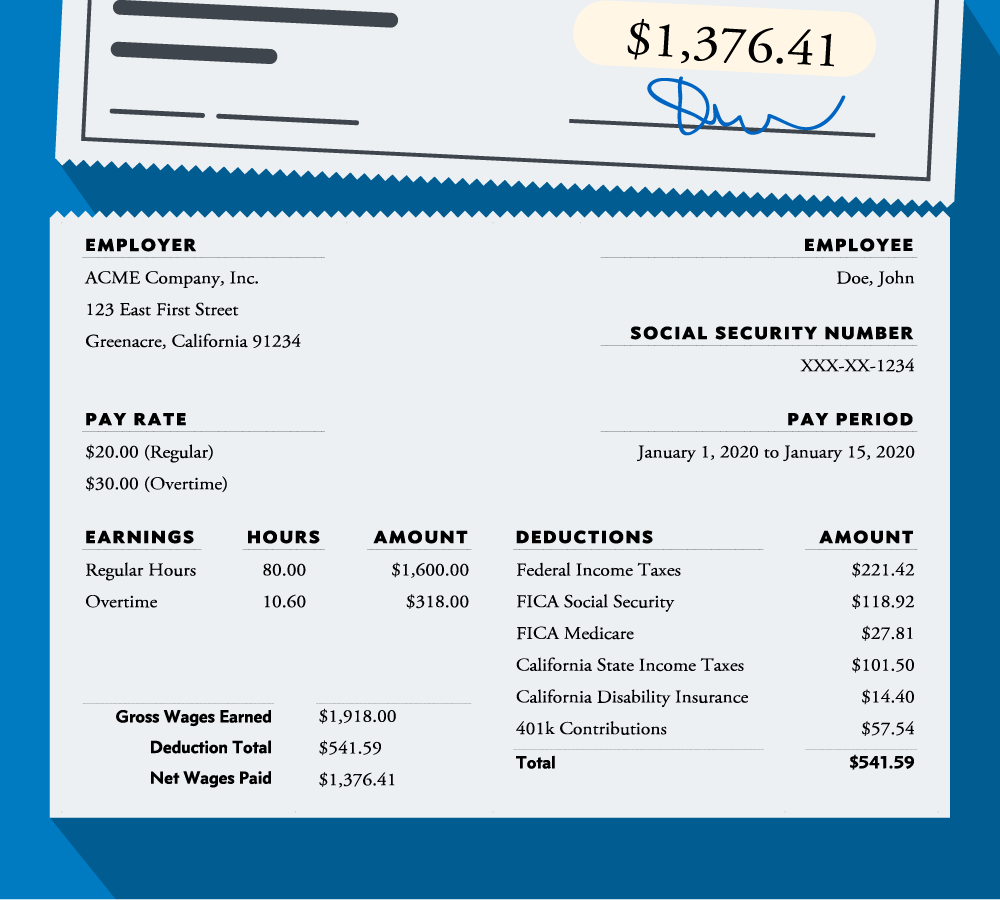

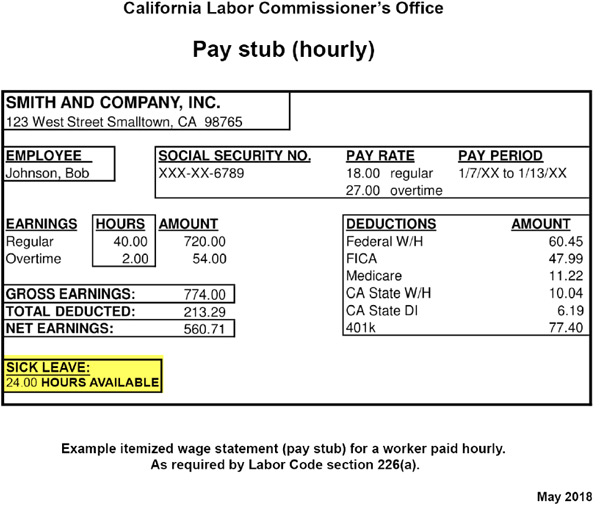

Employee Name And Last Four Digits Of Social Security Number (Ssn) Or.

Starting on january 1, 2024, employers must generally provide 5 days or 40 hours of paid sick leave to their employees in california.

California Pay Data Reporting Is Due May 8, 2024 (Now With New Requirements!) By Jonathan Slowik &Amp; Michelle Lappen On March 21, 2024 As Readers.

2 what about exempt employees, salaried employees, and employees who are paid in cash?

Employers Who Do Not Comply With The.

Images References :

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

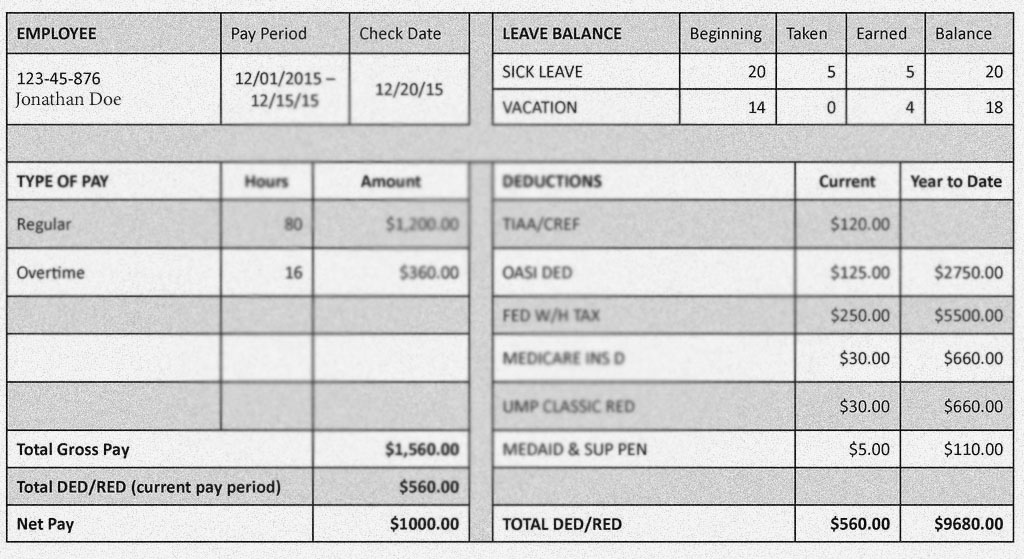

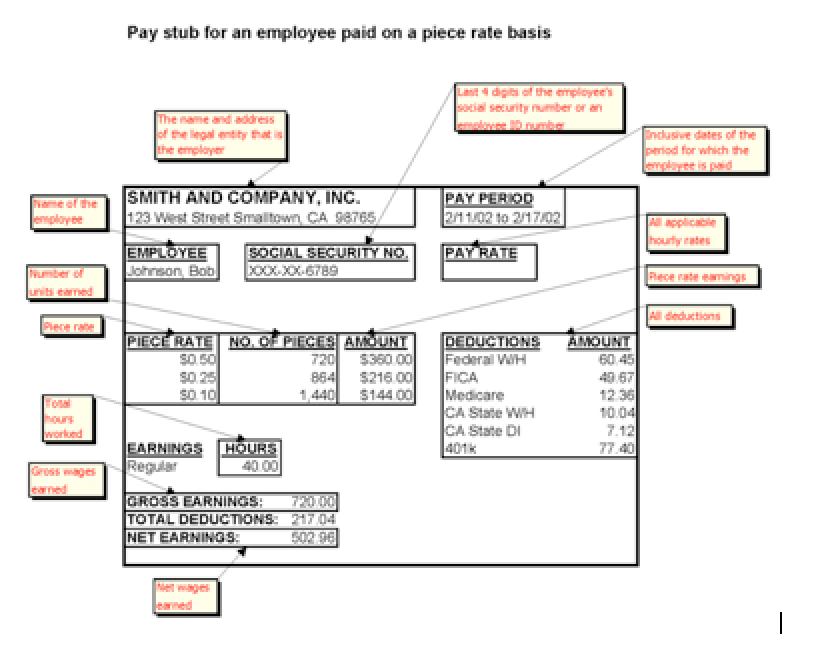

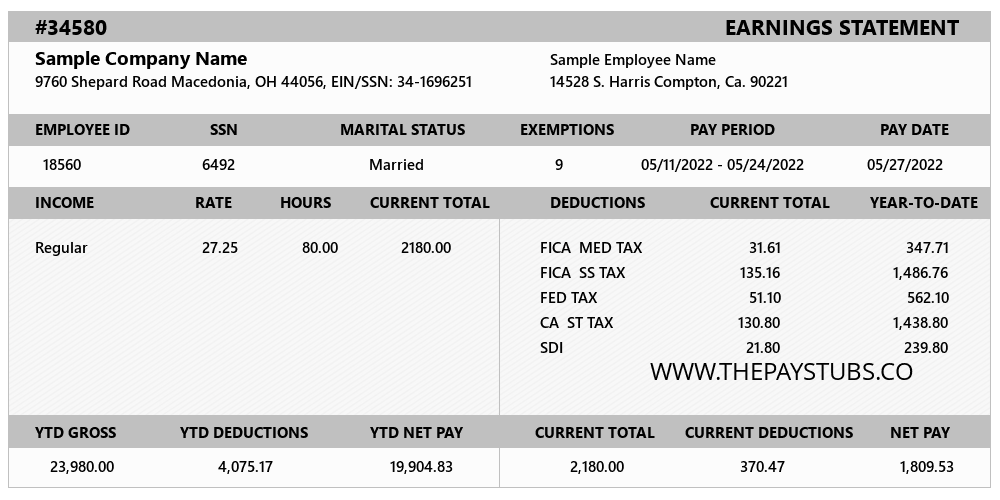

California Pay Stub Template, California labor code §226 lists the information that employers must include on a california employee’s pay stub. Employers who do not comply with the.

Source: deutschinporno.com

Source: deutschinporno.com

What Free Paycheck Stub Template Has Provided To The Employers And, Unlike last year’s reporting period, it does not appear that the crd will be accepting or granting any pay reporting. Below are the key updates:

Source: parris.com

Source: parris.com

California Pay Stub Requirements Is Yours Compliant? PARRIS Law Firm, The california civil rights department (crd) updated its pay data reporting resources for 2024. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in advance as regular paydays.

Source: www.paycheckstubonline.com

Source: www.paycheckstubonline.com

California Check Stub Generator Check Stub Maker CA, California law requires specific information to be included on your pay stub (or wage statement) so that you have an accurate understanding of how your wages. 2 what about exempt employees, salaried employees, and employees who are paid in cash?

Source: bakerllp.com

Source: bakerllp.com

Paystub Requirements Under California Labor Code Section 226 BakerLLP, Below are the key updates: California senate bill 1162 (sb 1162), the pay transparency act, went into effect on january 01, 2023.

Source: www.thepaystubs.co

Source: www.thepaystubs.co

Online Free Pay Stub (paycheck stub) Generator, Below are the key updates: California pay data reporting is due may 8, 2024 (now with new requirements!) by jonathan slowik & michelle lappen on march 21, 2024 as readers.

Source: www.pinterest.com

Source: www.pinterest.com

California Hourly Employee PayStub Generator, Below are the key updates: The california civil rights department (crd) updated its pay data reporting resources for 2024.

Source: dyanncarina.blogspot.com

Source: dyanncarina.blogspot.com

10+ Proof Of Wage Loss Paystub DyannCarina, In california, employers are legally required to include certain information on. Reports are due by may 8, 2024.

Source: topclassactions.com

Source: topclassactions.com

California Pay Stub Requirements Top Class Actions, California’s pay data reporting portal opened on feb. Unlike last year’s reporting period, it does not appear that the crd will be accepting or granting any pay reporting.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

California Pay Stub Template, In january 2024, california again updated its pay data reporting website for the 2024 reporting cycle. As of 2024, several states have implemented or updated their pay stub regulations to enhance transparency and protect employee rights.

Employees Can Recover Up To $4,000 In Pay Stub Violation Penalties.

The portal in which employers must submit their pay data reports will open on february 1, 2024.

Below Are The Key Updates:

California employers need to gear up for the latest enhancements in pay data reporting in 2024.